Cyber Threats: Are You Protected?

Return To: Cyber Insurance – The Ultimate Guide You’ve done your research. You’ve hired a reputable cybersecurity company to keep your business safe from hacker threats to your social media and internet transactions. That’s all you need to be protected. Right? Unfortunately, no. With the digital age surging all around us, the threat to our […]

Four Reasons You Need Homeowner’s Insurance

Whether you just bought your new home or are still paying off the mortgage, having a homeowner’s insurance coverage is important. For most people, the home is their biggest asset and it is, therefore, important to protect it. Although most people understand the importance of a homeowner’s insurance coverage, many homes are still not covered. […]

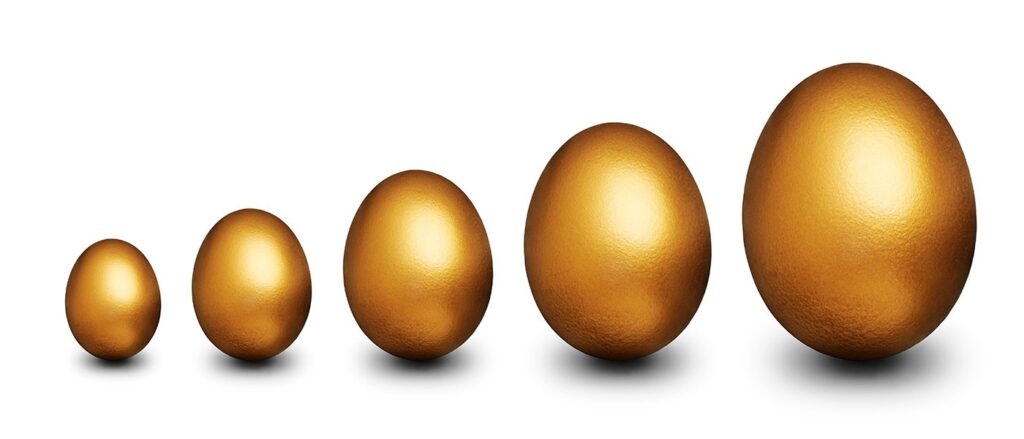

Pros and Cons of Fixed Index Annuities

Fixed index annuities are a safe money alternative that more people, especially seniors, are considering. They are a good way to protect one’s assets while at the same time gaining some profits. With fixed annuities, one gets to earn a fixed amount of interest every year. Fixed annuities work in a similar way to Certificate […]

Why Businesses Need Umbrella Insurance

As long as you own a business, it is important to bear in mind that you are at risk of a lawsuit. As such, it is best to be prepared should this happen. Most business owners will argue that they have enough general insurance coverage. In most cases, however, general insurance does not entirely cover […]

The Importance of Boat Insurance

Owning and maintaining a boat can be quite expensive regardless of what state you live in. While boating is a common recreational activity for many Americans, some boat owners do not fully understand the importance of boat insurance. Well, we do not blame them. Getting boat insurance may seem like an odd thing to do. […]

What Does Disability Insurance Actually Do?

There are so many types of insurance coverage and the disability insurance coverage is one of them. However, it is among the least used coverages. Most people do not know what it is all about and for this reason, most do not bother to take up this particular policy. The disability insurance coverage is a […]

How Does Life Insurance Work?

Life insurance is a type of insurance that pays a certain amount of money to the beneficiaries of a person the insurance covers following their demise. Alternatively, this payment could be made after the set contractual period is done. This policy works to ensure that the insured person’s beneficiaries’ needs are catered for even after […]

Common Types of Insurance

Unless you live under a rock, you most probably know what insurance is. If not, it is a form of risk management that issued to act as a means of protection from unforeseen events that may cause financial loss. The most commonly bought insurance packages include car insurance, house insurance, business insurance and personal life […]

Why Variable Annuities Should be in Your Retirement Plan

Just as is the case with any annuity, a variable annuity is a contract between you and the insurance company. Variable annuities are tax-deferred contracts that allow you to make a choice between some investments. After retirement, the insurance company pays you out some income depending on the payout of the investments that you chose. […]

Landlord Package Insurance vs. Rental Property Insurance

LANDLORD INSURANCE The main problems that face landlord insurance are the occurrence of accidental damages, liabilities from misuse of the property by the tenants and structural damages to the building. Despite all these problems landlords insurance also has its benefits which include; Investment protection Being a landlord means that the property which you rent is […]