Estimated reading time: 6 minutes

Return To: Flood Insurance – The Ultimate Guide

“Am I In A Flood Zone?” This is a question we hear quite often. This article should help shed some light on the topic.

In case you were wondering what the answer actually is…

EVERYONE is in Flood Zone, so let’s learn a little more about FEMA Zones.

With continuous development happening all around you, it is easy to overlook flood zones. A sudden flood can set you back financially when you have no preparations. Most home insurance policies do not provide coverage for floods, so you need to know if the area you’re in a high-risk flood zone. These designations can change over time, so keeping up to date is the best practice.

FEMA Flood Zones

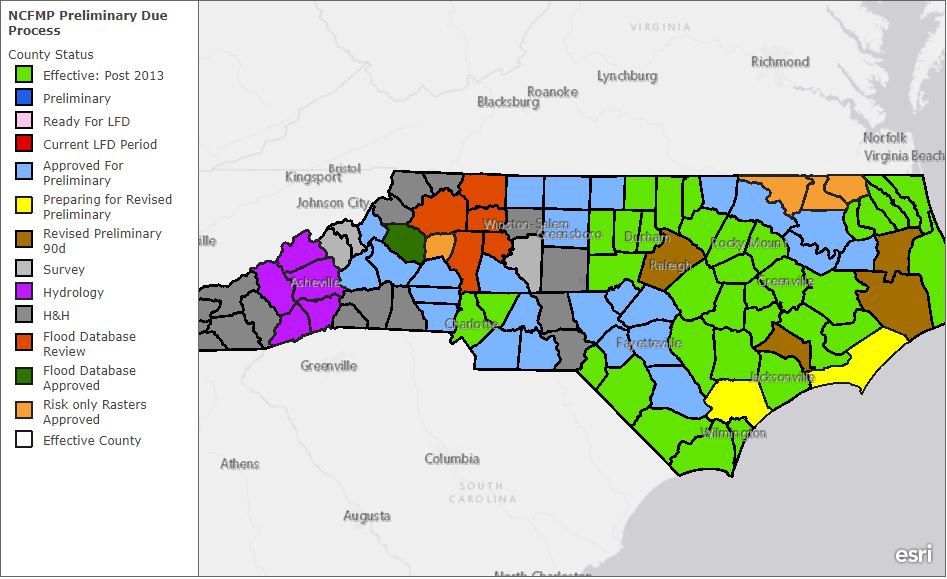

One of the best ways to find out if your area is a flood zone is through the Federal Emergency Management Agency (FEMA). They have a Flood Map Service Center, which shows flood zones in the US. The FEMA Flood Mapping will give you information about various infrastructure for floods. You’ll know if you have a nearby coastal barrier and the base flood line.

FEMA identifies flood zones through the use of a flood map. They create a flood map by collating all available information. They partner with local and tribal officials to gain information about the risk of the area. They take into account infrastructure, current maps, land usage, and more. From there, they then assess the risk of flooding and assign flood zone designations.

If they have enough data, they create the risk report and map. The map uploads online, where the community can comment on or appeal the assessment. After this is settled, FEMA adopts a finalized flood map within six months. It details flood hazards and efforts underway to mitigate the risk of flooding.

Once you access the website, you gain the most relevant and up-to-date information available. You’ll gain access to the flood map, which shows the risk around your property. Here are all the flood designations.

Low to Moderate Risk Flood Zones

These zones have a lower chance of flooding. If the community participates in the NFIP, insurance will be available if the property owners want it.

What Is Flood Zone X?

Flood zone x often appears as shaded or unshaded. A shaded flood zone x has a moderate flood risk. These areas are between the limits of 100 to 500-year floods (frequency). When unshaded, it means that the zone has minimal risk of flooding. An unshaded X is outside a 500-year flood frequency and has a levee that protects it from 100-year floods.

What Is Flood Zone B?

Zone Bs are base floodplains but of lesser hazards. These are shallow flooding areas with less than one foot of flooding or drainage. These areas are also likely protected by levees from 100-year floods.

What Is Flood Zone C?

Zone C is an area that may have the possibility of drainage and ponding problems. However, they are not big enough to warrant a detailed study. It is a minimal flood hazard above the 500-year flood level.

High-Risk Flood Zones

Insurance is mandatory for all property owners within these areas. The necessary insurance is available in the community as a part of the NFIP.

What Is Flood Zone A?

This flood zone has a 1% annual chance of flooding. Due to the lower percentage, no detailed analysis is available for these areas. Flood Zone A has a 26% chance of flooding within a 30-year mortgage span.

What Is Flood Zone AE?

Flood Zone AE is a base floodplain. Detailed elevations are publicly available for these areas. AE zones are a newer format derived from A1-A30 zones.

What Is Flood Zone A1-A30?

This is another base floodplain. The numbered A zones showcase an older format, as the flood map has not yet gone through new updates.

What Is Flood Zone AH?

AH has a 1% chance of shallow flooding within a year. Floods usually range from 1-3 feet and form a pond. Like flood zone A, they have a 26% chance of flooding within a 30-year mortgage. An AH zone has more details, including base flood elevations.

What Is Flood Zone AO?

An AO flood zone is an area near a river or stream. These areas have a 1% or higher chance of shallow flooding each year. They also have a 26% chance of flooding in 30 years, with floods having a range of 1-3 feet.

What Is Flood Zone AR?

These areas are undergoing a flood control system upgrade or restoration. Due to this new construction, the zone has a temporarily increased flood risk. In these cases, insurance rates will not exceed unnumbered A zones. This remains true as long as the structure complies with floodplain management regulations.

What Is Flood Zone A99?

An A99 flood zone has a 1% chance of flooding within a year and has protection by a federal flood control system. No additional details are available in these areas.

High-Risk Coastal Flood Zones

Flood insurance is also mandatory in these areas. Coastal zones often have the marking V.

What Is Flood Zone V?

A V zone has a 1% or greater chance of flooding within the year due to storm waves. Chances of flooding within 30 years remain at the same 26% rate. No additional details are available in these zones.

What Is Flood Zone VE and V1-30?

A VE/V1-30 is a coastal area with a 1% or greater chance of flooding within a year due to storm waves. The percentages of flooding during a 30-year mortgage are the same as in other areas. These zones have more details with base flood elevations listed.

Other Flood Zones

These zones have no analysis that comes along with them. Due to this, the risk is uncertain.

What Is Flood Zone D?

A D flood zone has an undetermined flood zone hazard. Due to the uncertainty and lack of research, insurance rates can vary.

How Do I Find Out If a Property Is in a Flood Zone?

The easiest way to determine your property’s flood hazard status is through the FEMA Map Service Center. Once you get to it, input your property address, and it will show you a map. The flood hazard zone will also appear alongside the map. At times, the map will only show part of your property. It means that only that part is at risk of flooding.

If you’re still unsure, you can always ask your insurance agent to help you. They can check the FEMA Map Service Center on your behalf and give you details on the FEMA assessment.