Estimated reading time: 6 minutes

Return To: North Carolina Homeowners Insurance – The Ultimate Guide

Making sure you have the right gun insurance for your firearms and ammunition doesn’t have to be complicated. Surprisingly, most gun owners have no idea whether or not their weapons are covered by insurance.

In fact, many times they will look to specialty insurance companies to insure their guns even though they might already have coverage on their home insurance or renters insurance.

In this article we will look at the different options you have to protect yourself & your guns!

Are Guns Covered Under Homeowners Insurance?

Homeowners Insurance does provide coverage for guns & firearm related equipment (ammunition, scopes, silencers, etc). Gun Insurance Coverage that protects your weapons from physical loss is found under the Personal Property Section (Coverage C) of your home insurance.

In addition, home insurance can provide gun owners with some protection from lawsuit under the Liability Section of the homeowners policy as well as extending to the Personal Umbrella Liability. Obviously, there are limitations with what types of actions would be covered, but some liability protection exists.

Standard Insurance Coverage For Firearms

Personal Property Coverage found on the major home insurance policy forms (renters insurance, condo insurance, homeowners insurance) provides coverage for “your stuff”. In general, we are referring to the items in your home that aren’t physically attached to the house.

Guns & Ammunition that you own, like other belongings, are considered to be a part of your personal property. So, your firearms have basic coverage against physical loss or damage just like the rest of your property (with some differences we will discuss later).

Firearm Liability Insurance

Homeowners & Renters Insurance Policies are comprised of two sections:

- Section I – Property Coverages

- Section II – Liability Coverages

The liability section of the policy provides protection if a claim is made or a lawsuit is brought against you for bodily injury or property damage caused by a covered occurrence.

In general, the liability section protects you for non-intentional acts or occurrences that someone might bring suit against you.

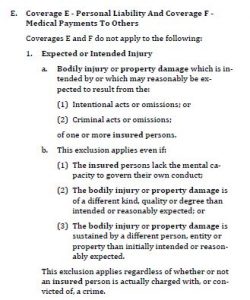

However, there is a MAJOR exclusion that seems likely when it comes to firearm related lawsuits.

Most major Home Insurance Policies contain the following Exclusion:

Most major Home Insurance Policies contain the following Exclusion:

- Expected Or Intended Injury

- Bodily Injury or property damage which is expected or intended by an insured

This simply means that the insurance carrier will not provide coverage if the act is “Intentional”.

Let’s look at two real world examples

DISCLAIMER: These examples are meant to provide some clarity. Every claim is looked at on the merits of each individual claim and circumstance

EXAMPLE ONE

While cleaning your gun, the firearm accidentally discharges. The bullet is shot toward your neighbor’s backyard where it strikes and injures someone.

That injured party makes a claim against you for his injuries.

COVERED

EXAMPLE TWO

While having some people over at your house, you get in an argument with someone. Tensions escalate and you use your firearm to shoot the person in the leg.

The injured party makes a claim against you for his injuries.

NOT COVERED

Better Home Insurance = Better Gun Owners Insurance

Not all Home Insurance Policies are created equal. You should research the Different Types Of Home Insurance Policies that are available in your area.

Your guns are insured against losses as defined in the policies “perils insured against”. Most policies (Homeowners (HO3 version), Renters (HO4), and Condo (HO6)) provide coverage against Named Perils.

What Are The Named Perils For Personal Property (Coverage C)

- Fire Or Lightning

- Windstorm Or Hail

- Explosion

- Riot Or Civil Commotion

- Aircraft

- Vehicles

- Smoke

- Vandalism Or Malicious Mischief

- Theft

- Falling Object

- Weight Of Ice, Snow Or Sleet

- Accidental Discharge Or Overflow Of Water Or Steam

- Sudden And Accidental Tearing Apart, Cracking, Burning Or Bulging

- Freezing

- Sudden And Accidental Damage From Artificially Generated Electrical Current

- Volcanic Eruption

If your Homeowners Policy is on an Enhanced Form like the North Carolina Homeowners Insurance Form HE7, then your Personal Property is insured on an All Risk basis.

An All Risk Insurance Form states that EVERYTHING is covered unless the peril specifically excluded in the policy. Refer to your policy information for the Specific Exclusions.

Does Insurance Cover Stolen Guns?

Homeowners Insurance COVERS stolen guns. However, there are special limits that apply to Gun Insurance when it comes to theft, misplacing, or losing of firearms.

| Homeowner’s Form (Type) | Amount Of Gun Coverage | Perils Insured Against |

| Homeowners Form HE7 | $10,000 | Theft + Lost + Misplacement |

| Homeowners Form HO3 | $2,500 | Theft |

| Condo Form HO6 | $2,500 | Theft |

| Renters Form HO4 | $2,500 | Theft |

For most home insurance policies, the limit is $2,500 for loss by theft of firearms and related equipment.

The North Carolina Homeowners Form HE7 increases this coverage to $10,000 and actually broadens the language to include Misplacing or Losing of firearms and related equipment.

Do I Need A Special Gun Insurance Policy?

There are times when the coverage provided by standard Home Insurance or Renters Insurance aren’t enough. Sometimes you are better served to add the Schedule Firearms Endorsement to your policy.

Gun Collection Insurance

If you own a collection of guns you should purchase the optional Endorsement for Scheduled Firearms if the value of your collection exceeds the amount of coverage given on the homeowners policy OR you wish to expand the types of perils your collection is insured for.

High Value Firearm Coverage

Much like if you own a collection of firearms, if you own any weapons that have increased value due to the type, make, age of the firearm then you should consider purchasing the optional Scheduled Firearms Endorsement.

How Much Does Gun Insurance Cost

The cost of Gun Owners Insurance depends upon the type and amount of firearm insurance you need.

The cost to insure your guns and related equipment for the standard Personal Property Insurance Perils is $0. This is automatically included in the standard home insurance policy.

Firearm Owners Insurance cost remains $0 as long as the amount of theft coverage you need is $2,500 or less. This, too, is automatically included in the standard home insurance policy.

If you live in North Carolina and need more than $2,500 of theft coverage for your firearms, then you can upgrade your policy to the HE7 Home Insurance Policy where the coverage increases to $10,000.

Typically, the price difference between an HO3 policy and an HE7 policy with the same carrier is less than $50 a year.

You Can Insure Your Firearms On A Scheduled Policy for approximately $1.50 to $2.00 per $100 Of Coverage

In order to provide the Best Gun Insurance, you will need to schedule your firearms on Scheduled Firearms Endorsement. Pricing will vary on this endorsement, but you are generally looking at $1.50 to $2.00 per $100 of coverage.

North Carolina Firearm Insurance Expert

Gun owners take pride in their firearms. For some, this means you could have thousands of dollars worth of firearms and equipment. Make sure you know what you are covered for, and what you are NOT covered for. Contact ALLCHOICE Insurance today for more information.